by Kent Thiesse, Farm Management Analyst, Green Solutions Group

ECO AND SCO INSURANCE COVERAGE OPTIONS FOR 2025

As has been often said with farming …… “every year is different”, and many times decisions for the current crop year are based on what happened in the previous year or two. That could be the scenario in some cases with considering the Enhanced Coverage Option (ECO) and Supplemental Coverage Option (SCO) insurance coverage options for 2025. ECO insurance have been around for several years but has not been considered on a widespread basis due to the relatively high premium rates for ECO coverage; however, that scenario could change in 2025 due to much lower premium levels. SCO coverage may also be a viable option for corn in some instances, together with the PLC farm program choice, as part of an overall risk management package.

Details on ECO Insurance Coverage

The Enhanced Coverage Option (ECO) provides area-based insurance coverage from 86 percent up to 95 percent coverage, with producers having a choice between 90 or 95 percent ECO coverage. ECO insurance coverage is available with selection of either Price Loss Coverage (PLC) or Ag Risk Coverage (ARC) farm program choices for the 2025 crop year. Farmers do not have to purchase SCO coverage in order to purchase ECO; however, they can purchase both if desired. The Federal government has increased the premium subsidy for ECO insurance coverage from 44 percent in 2024 to 65 percent for 2025, which makes premiums for ECO coverage options more affordable in 2025. It is estimated that 2025 ECO premiums will likely decline by 30-40 percent compared to a year earlier.

Many crop insurance companies have combined ECO coverage with traditional RP coverage to offer some very attractive risk management insurance packages for the 2025 crop year. Some insurance companies are also offering private crop insurance buy-up policies that dove-tail with ECO coverage. Interested producers should check with their crop insurance agent for details on 2025 ECO insurance coverage options and premiums to optimize their crop insurance coverage for 2025.

Details on SCO Insurance Coverage

The Supplemental Coverage Option (SCO) coverage is only available to producers that choose the Price Loss Coverage (PLC) farm program option for the 2025 crop year. The farm program enrollment deadline is April 15 in 2025; however, the crop insurance enrollment deadline is March 15, 2025. This means that farm operators will need to consider both choices by March 15 if they want to utilize SCO insurance coverage. SCO allows producers to purchase additional county-level crop insurance coverage up to a maximum of 86 percent, over and above the underlying crop insurance policy. For example, a producer that purchases an 80% RP policy could purchase an additional 6% SCO coverage. The federal government subsidizes 65% of the premium for SCO coverage, so farm-level premiums are quite reasonable.

How ECO and SCO Insurance Coverage Function

ECO and SCO are county revenue-based insurance products that are somewhat similar to the area risk protection crop insurance products that are available. The calculations for ECO and SCO function very similarly to RP insurance policies, utilizing the same crop insurance Spring price and harvest price as RP policies. The 2025 crop insurance Spring price is based on the average Chicago Board of Trade (CBOT) prices for December corn futures and November soybean futures in February of 2025, while the harvest price is based on the averages of the same CBOT futures months in October.

Producers can utilize both ECO and SCO insurance coverage together, in addition to their underlying RP, RPE, or YP insurance policy. The biggest difference from most RP insurance policies is that ECO and SCO utilize county level average yields, rather than the farm-level APH yields that are used for RP policies. As a result of utilizing different yield calculations, the SCO and ECO insurance policies may achieve different results than the underlying RP policy.

It is possible for a producer to collect on an individual RP policy, but not collect on a SCO or ECO policy, or vice versa. For example, a producer with an 85% RP policy may have a loss that qualifies for an insurance indemnity payment on a farm unit, while the county as a whole may not meet the threshold to qualify for a SCO or ECO payment. It could also be possible to collect an ECO or SCO payment for a county-level revenue loss, while not qualifying for a RP insurance indemnity payment at the farm-level, depending on the RP coverage level.

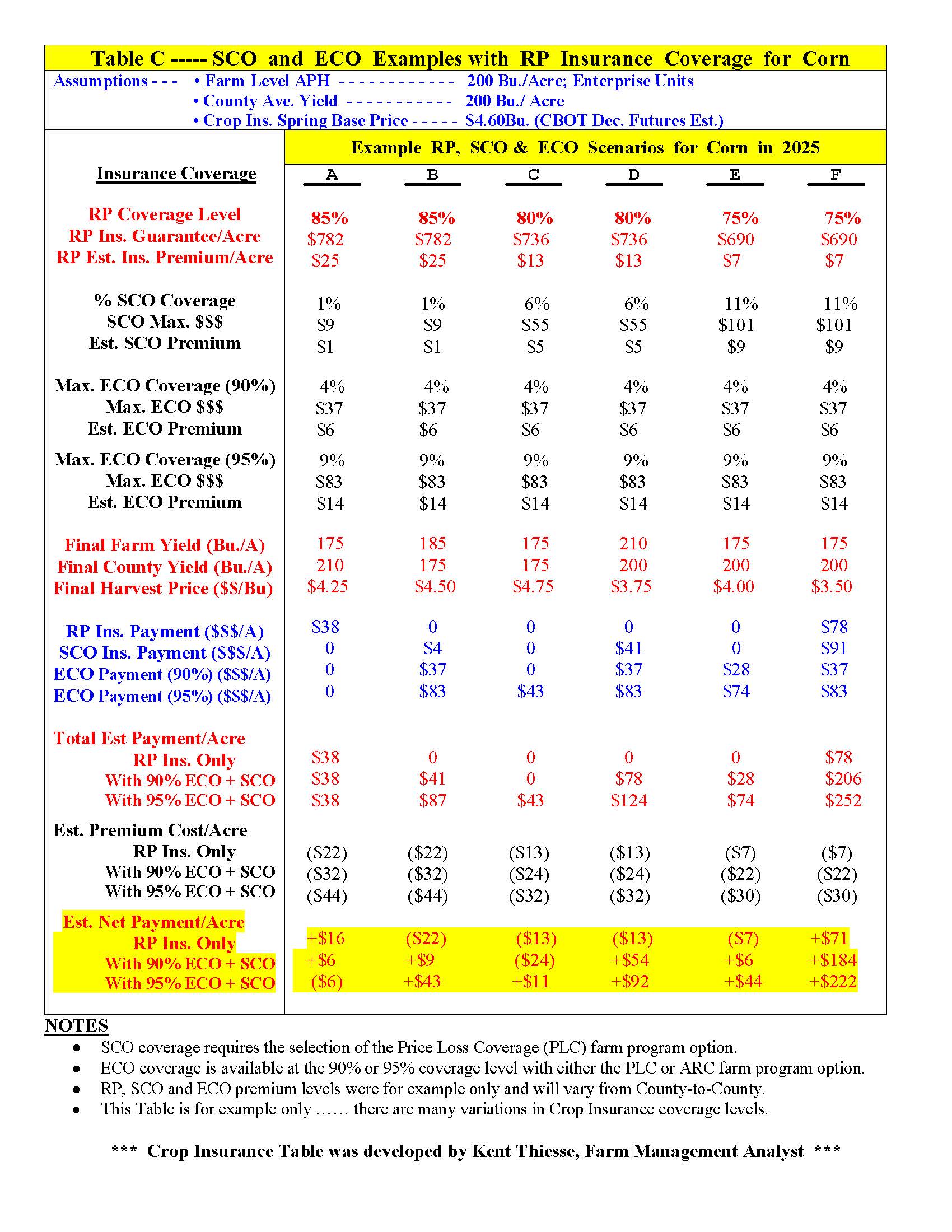

Example of how the ECO and SCO insurance coverage options might function for corn:

Assume a producer signs up for the PLC farm program option for 2025 and enrolls in 80 percent RP crop insurance coverage for corn in 2025. The producer decides to utilize SCO insurance coverage from 80% to 86% coverage, and then adds ECO coverage from 86% to 95%. In this example, it will be assumed that the farm APH yield and the county yield guarantee are both 200 bushels per acre, and that the 2025 Spring corn price is $4.50 per bushel. The farm level guarantee (at 80%) is $720 per acre. The SCO (6%) adds a maximum of $54 of coverage and the ECO (9%) adds a maximum of $81 of coverage.

Here are three different scenarios with varying results:

- Scenario #1 --- Final farm level and county yield at 200 bushels per acre. Final 2025 harvest price is $3.60 per bushel

RP payment = Zero (200 bu./A x $3.60/bu. = $720/A; same as guarantee) SCO payment = $54/A; ECO payment = $81/A

- Scenario #2 --- Final farm level at 160 bushels per acre and county yield at 200 bushels per acre. Final 2025 harvest price is $4.30 per bushel

RP payment = $32/A (160 bu./A x $4.30/bu. = $688/A; $720/A guarantee) SCO payment = Zero; ECO payment = Zero

- Scenario #3 --- Final farm level is 180 bu./A and county yield at 190 bushels per acre. Final 2025 harvest price is $4.20 per bushel

RP payment = Zero (180 bu./A x $4.20/bu. = $756/A; exceeds guarantee) SCO payment = Zero; ECO payment = $57/A

NOTE --- There is an additional example on page 3.

The ECO coverage option allows farm operators the opportunity to greatly enhance their crop insurance coverage for 2025 at a fairly reasonable premium rate. The ECO is especially effective to protect crop revenue from unexpected price drops to corn or soybeans by next Fall. The SCO insurance coverage could be a viable option for producers that select the PLC farm program option for 2025, especially for corn. The corn reference price for the PLC program increased to $4.26/bu. in 2025, which makes PLC a much more viable farm program option for corn this year. When selecting PLC, a producer could utilize an 80% or 85% RP policy together SCO to reach 86% coverage, and then add ECO to achieve a total of 90 or 95 percent coverage.

Farmers should contact their crop insurance agent for details, premium quotes, and spreadsheets on various crop insurance coverage options, including ECO and SCO. Kent Thiesse, Farm Management Analyst, has prepare, and two information sheets titled “2024 Farm Program Decision Cheat Sheet” and “2024 Crop Insurance Decisions” To request a free copy of these information sheets, send an e-mail to: kentthiesse@gmail.com

Some other good farm program and crop insurance resources include:

-

- U of Illinois FarmDoc website --- https://farmdoc.illinois.edu/

- Kansas State University --- https://agmanager.info/

- Iowa State University --- https://www.extension.iastate.edu/agdm/#

- USDA Risk Management Agency (RMA) --- https://www.rma.usda.gov/

For additional information contact Kent Thiesse, Farm Management Analyst, Green Solutions Group

Phone --- (507) 381-7960; E-mail --- kentthiesse@gmail.com